Investment Portfolio Pricing

Investment portfolio pricing refers to the method of valuing the assets held within an investment portfolio.

Investment Portfolio Pricing

Pricing is the most important profit lever for a business, and so, it plays a prominent role at all stages of the deal lifecycle for Private Equity & Venture Capital funds.

Pricing research is crucial to making the right acquisitions and investments to discover undiscovered pricing potential, ensure the accuracy of revenue forecasts, and analyze opportunities for additional value creation. Moreover, optimizing prices for portfolio companies is key to driving growth and creating value, alongside maximizing the returns from the exit.

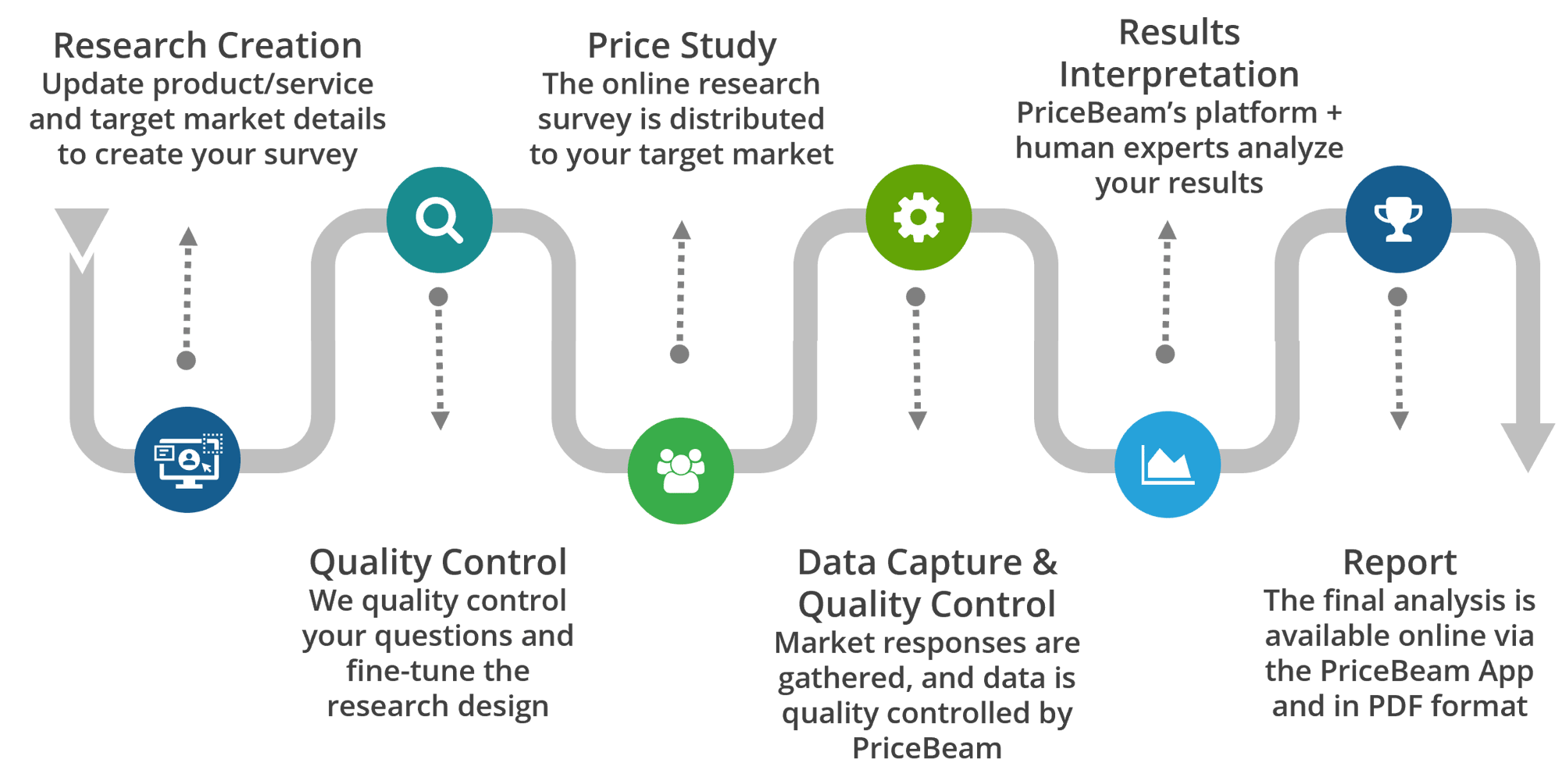

How Does It Work?

PriceBeam’s solution conducts extensive market research, collects and analyzes data before delivering a detailed report on your customer’s willingness to pay. This data will enable you to stick out from the competition, maximize profit, and set prices that aid your long-run brand positioning.

Define offering & target market

You describe your product/service on our cloud-based platform. You also define the target market to research.

Create Market Research

We add all the research details, statistical setup, etc. so you don't have to worry about it.

Conduct Market Research

We collect responses about the given product/service in the defined target market.

Analysis & Results

The results are aggregated, analyzed and presented in our cloud-based solution.

.png?width=400&height=100&name=PBLogoTransparent%20(1).png)