Pricing in Mergers & Acquisitions

Accurate pricing before and after a merger or acquisition is essential because it directly influences the amount the acquiring company is prepared to offer and determines the transaction's structure. This accuracy affects both the immediate success of the merger or acquisition and the long-term financial health of the merged entity.

Pricing and M&A

When a company decides to acquire or merge with another company several pricing-related points must be addressed, both pre- and post-acquisition/merger.

Before an acquisition or merger, it is important to analyze the pricing power of the target, and hereunder, what potential there is. Pricing is the most important profit-lever for a business, and the degree to which there is scope for improvement has a significant effect on the company valuation. A thorough analysis of the willingness to pay for the target’s product or service is therefore crucial.

After an acquisition or merger has taken place it is time to benefit from the synergies. With a horizontal acquisition, it must be decided whether to charge the acquirer or the acquiree’s prices and which company brand has the highest pricing power. With vertical acquisitions, it is necessary to determine whether the acquirer’s brand can be leveraged for charging higher prices, and if so, what should that higher price be?

How Does It Work?

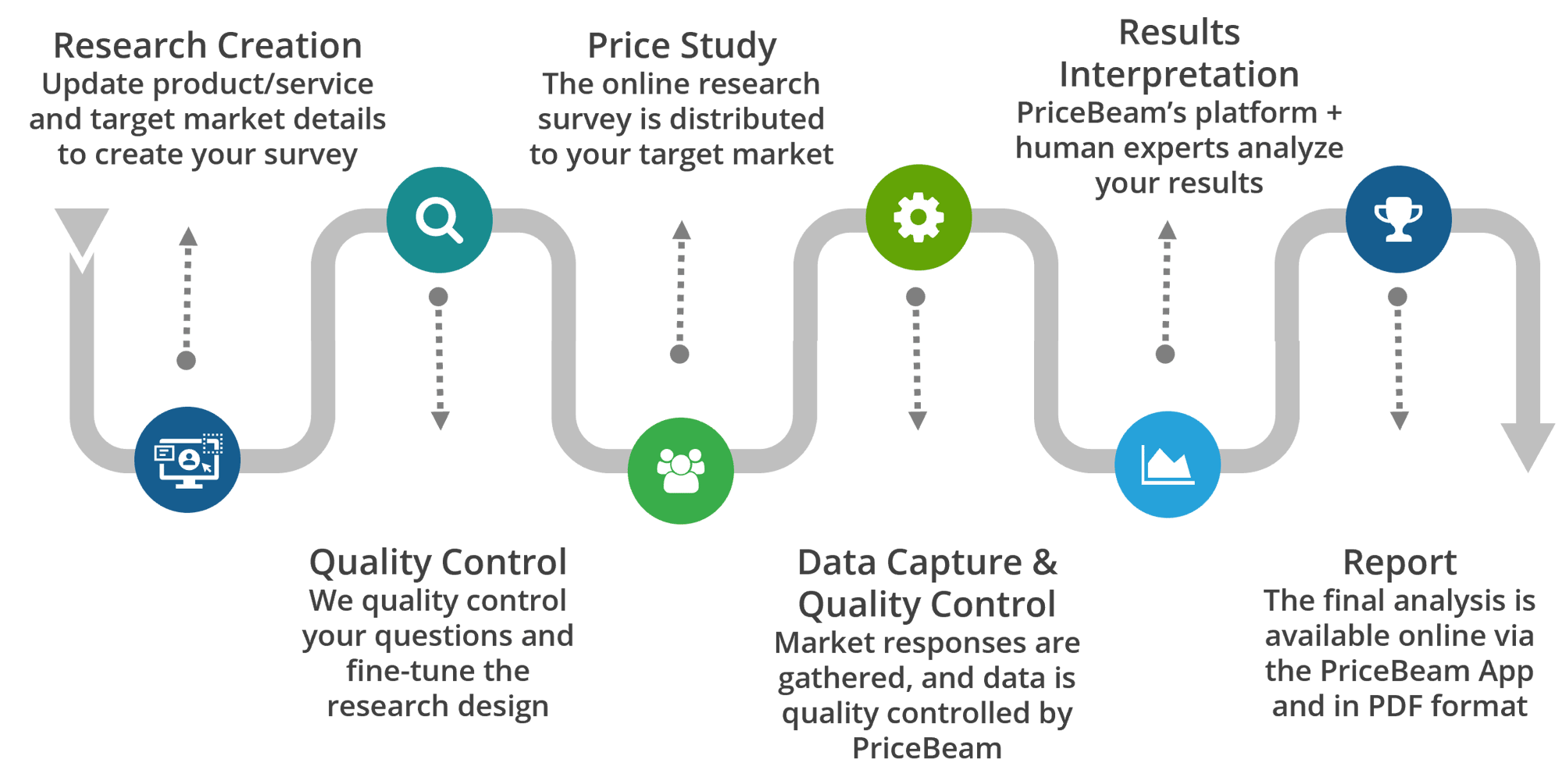

PriceBeam’s solution conducts extensive market research, collects and analyzes data before delivering a detailed report on your customer’s willingness to pay. This data will enable you to stick out from the competition, maximize profit, and set prices that aid your long-run brand positioning.

Define offering & target market

You describe your product/service on our cloud-based platform. You also define the target market to research.

Create Market Research

We add all the research details, statistical setup, etc. so you don't have to worry about it.

Conduct Market Research

We collect responses about the given product/service in the defined target market.

Analysis & Results

The results are aggregated, analyzed and presented in our cloud-based solution.

Blog article: Leveraging Pricing and WtP insights in M&A

By leveraging pricing and WtP insights throughout the M&A process, companies can make more informed decisions, minimize risks, and maximize the value of their M&A activities.

.png?width=400&height=100&name=PBLogoTransparent%20(1).png)