Consumer Finance & Retail Banking Pricing

Banks and financial institutions come to PriceBeam to get help optimizing fee levels and bundle prices. PriceBeam’s services provide banks and financial institutions with data and consumer insight, to help identify which fees can be increased and which should remain low, so profits can be increased with minimum churn.

Challenges in Consumer Finance Pricing

Banks and financial institutions come to PriceBeam to help solve various challenges and gain insight into the market.

Competition.

Banks experience intense pressure from competition in the current regulatory environment, consequently commoditizing many banking products.

Churn rate.

PriceBeam's services provide banks and financial institutions with data and consumer insight, to help identify which fees can be increased and which should remain low, so profits in turn can be increased with minimum churn.

How PriceBeam Brings Value Find out more →

Price Positioning & Strategy

New Product Pricing

Understand consumers' willingness-to-pay for new products, and use such insights to optimize prices when launching innovative products.

Market Launch Pricing

Setting the right prices when launching into new markets is often a challenge for Consumer Finance companies. PriceBeam helps understand market differences and sets optimal price points for each.

Assortment Optimization

Use market research to understand the differences in willingness-to-pay across all items in an assortment, and optimize both prices and range.

Value Communicate

Understand the benefits and features that consumers value as well as those attributes that don't impact consumers' willingness-to-pay.

Price Increase

Prices should not be static. It is best practice to adjust prices upwards regularly, at least in line with competition and inflation, but often also higher thanks to brand innovations.

International Pricing

Prices vary across countries. Understand differences in willingness-to-pay per market and set prices accordingly.

Promotional Optimization

Understand consumers' potential reaction to different promotional mechanisms or discount levels, and optimize the overall revenue.

How Does It Work?

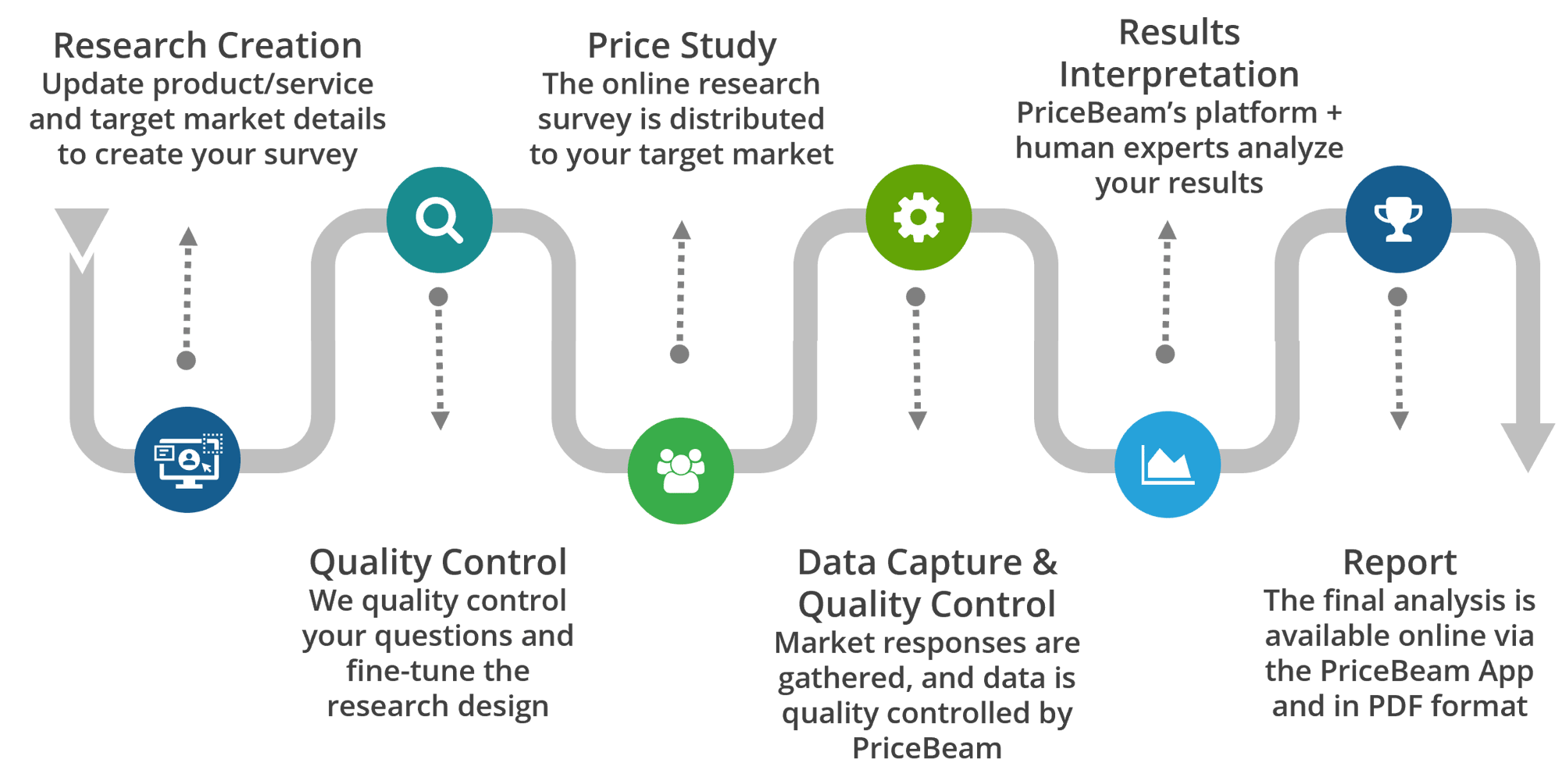

PriceBeam’s solution conducts extensive market research, collects and analyzes data before delivering a detailed report on your customer’s willingness to pay. This data will enable you to stick out from the competition, maximize profit, and set prices that aid your long-run brand positioning.

Define offering & target market

You describe your product/service on our cloud-based platform. You also define the target market to research.

Create Market Research

We add all the research details, statistical setup, etc. so you don't have to worry about it.

Conduct Market Research

We collect responses about the given product/service in the defined target market.

Analysis & Results

The results are aggregated, analyzed and presented in our cloud-based solution.

Why You Should Choose PriceBeam?

PriceBeam delivers strong value on a number of fronts, which is why our clients choose us.

Scientific Results

PriceBeam's studies ensure statistically significant results about willingness-to-pay.

Fast Insights

Results as fasts as 48 hours in B2C and 1-2 weeks in B2C.

Immediate Value

1% change in price delivers 11% improvement in value for the average company.

Easy to Use

You define the product and target market. PriceBeam takes care of the research and statistical details.

Global Reach

PriceBeam studies can be run in 127 countries. PriceBeam takes care of the localization.

Cost Effective

Using cloud technology, PriceBeam studies cost a fraction of classic, old-fashioned market research.

.png?width=400&height=100&name=PBLogoTransparent%20(1).png)